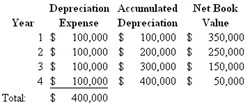

Depreciation-Depreciation must be calculated over time as equipment loses its value. There are multiple methods used to calculate depreciation.

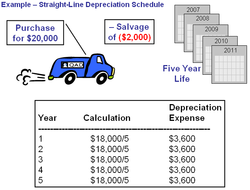

Straight-Line Method

This when an equal amount of depreciation is calculated each year. To find out the yearly deprecation you must take the annual depreciation expense and divide it by the 12 months in a year. This will give you the monthly depreciation. Then if the plant asset was used for 4 months, you take the monthly depreciation and multipy it by 4 (the number of months used) and you will get the partial year's depreciation.

Declining Balance

Multiplying the book value at the end of a fiscal period by the constant depreciation rate. The annual depreciation declines each year. The declining rate is based off of the straight line method. To calculate this you would take the beginning book value and multiply it by the deprecation rate. This would be your annual depreciation expense.

Discarding a Plant Asset

A plant asset may be discarded at any time. Sometimes the asset has a book value and other times it doesn't. If the plant asset has a book value there are two steps to discarding it. First you must remove the original cost of the asset and its accumulated depreciation. Then you must record the loss of the asset. A plant asset only has a loss if it is discarded while it has a book value. If the plant asset doesn't have a book value then you only need to record the plant asset for its original value.