Inventory Costing

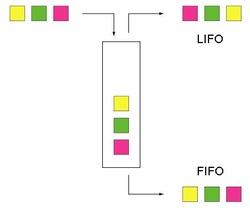

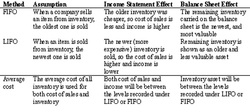

FIFO

FIFO stands for, first-in first-out. This uses the price of merchandise purchased first to calculate the cost of first merchandise sold.

LIFO

LIFO stands for, last-in last-out. This is the reverse method of FIFO. It is calculated by using the last merchandise sold and the last merchandise purchased.

Weighted Average

This method uses the average cost of beginning inventory and the merchandise purchased during the fiscal period. This will always be between FIFO and LIFO. This is calculated by taking the total cost and dividing it by the number of units purchased.